Rankuke Training Institute Leading the way...

T (+267) 390 7042

Cell: (+267) 7314 4144

Email: Email: info@rti.ac.bw

Rankuke Training Institute

Plot 51406 Kgaleview, Diratsame Mosielele Rd, Gaborone

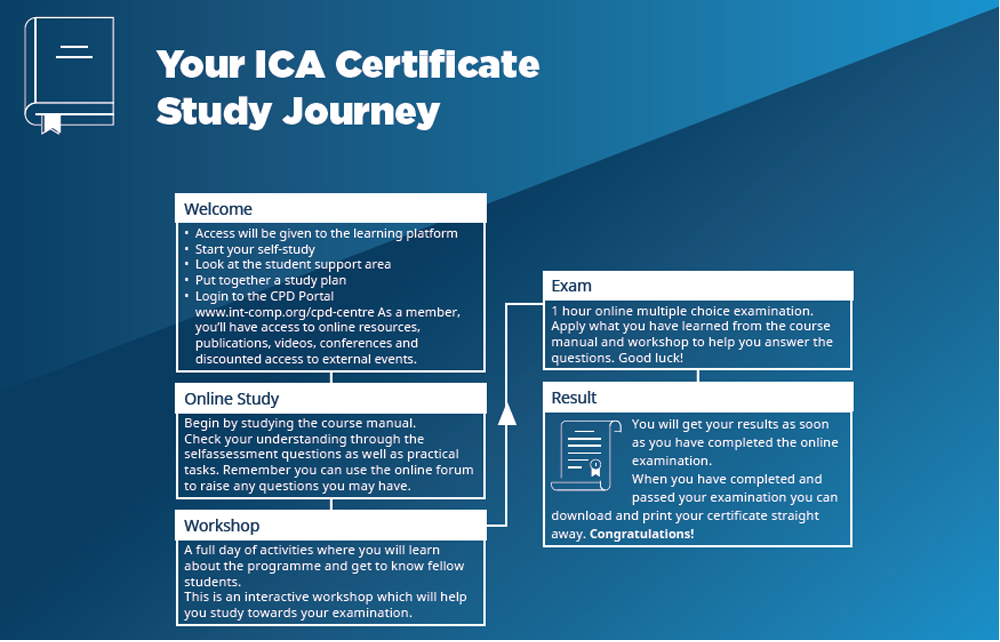

Entry Requirements

- Sound educational background

- Good written English skills

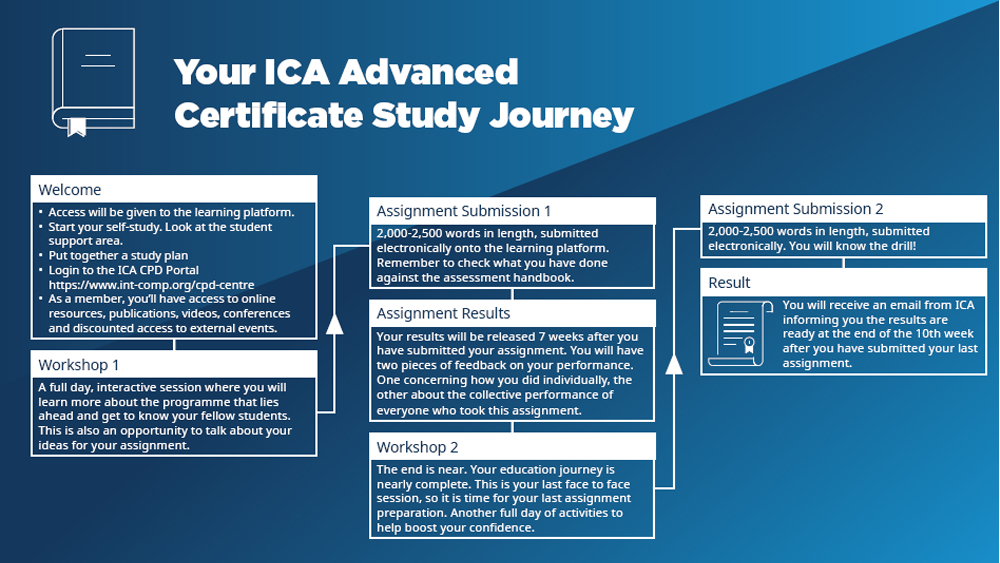

Entry Requirements

- Sound educational background

- Good written English skills

Entry Requirements

The content of this programme requires students to possess:

- Sound educational background, e.g. degree or professional qualification in an appropriate discipline OR

- Attainment of an ICA Advanced Certificate OR

- Three years relevant work experience

Entry Requirements

- Must be a senior practitioner (i.e., hold a senior management role) with at least three years’ experience in that role or at the equivalent level of seniority OR

- Possess an ICA Diploma, have at least five years’ experience in a related discipline and currently work in a role that includes senior level responsibilities and regular engagement with senior practitioners